AmTrav has tracked American Airlines’ fare changes since American removed many of their lowest fares on April 3 from corporate booking tools like Concur Travel, Deem and Egencia, reserving those lowest fares for NDC-enabled partners like AmTrav and AA.com.

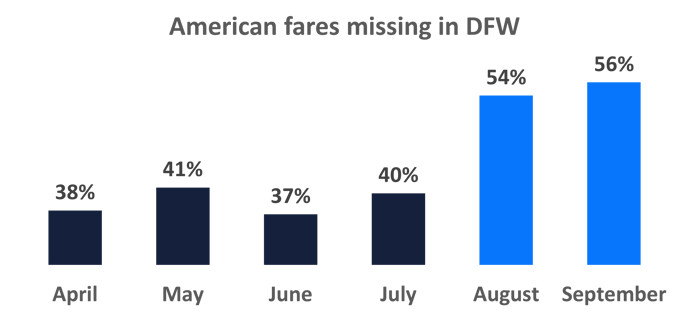

Through July, American averaged 37% of fares missing from those corporate bookings tools, including 39% of fares in DFW, American’s home and largest market.

But then on July’s Q2 earnings call, Chief Commercial Officer Vasu Raja said that American would get more aggressive and remove even more fares from those booking tools:

"We'll roll out those features also over time for new distribution technology. But as this happens, we'll make increasingly less and less of our fare content available through traditional technology where customers aren't able to get that quality experience that they're looking for from us."

Lo and behold, in August the portion of American fares removed jumped to 50%, including 54% in DFW, and stayed up at 56% in September for DFW (through September 12):

So what does this mean for corporate customers in the Metroplex like you? This means three things:

First, a lot of lower fares are missing. If your travelers happen to check AA.com or the American app – maybe they want to see a better seatmap than your corporate travel platform offers – there’s a 55% chance that they’ll find a lower fare on AA.com or the American app than in your corporate travel platform. Ouch! And while regular Economy that corporate travelers most often purchase had be affected less often than other fare types, Economy fares are affected a lot more now:

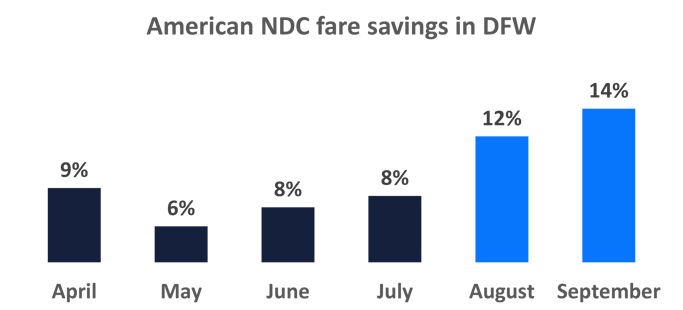

Second, this is costing your company a lot – if you don’t have access to these fares through a platform like AmTrav. Through July, companies without access to American’s lowest fares were paying 9% more on American out of DFW, that jumped to 13% in August and September:

Third, American is doubling down, not backing down.

Back in April many (myself included) were surprised that American implemented this strategy as promised – sometimes airlines bluff, but American wasn’t bluffing.

Fast forward to the second half of 2023, with five-plus months of results on billions of dollars in corporate spend, and American is removing even more fares.

What this means is that the pain for companies in the Metroplex – that 13% in extra American fare cost in DFW – is going to get even worse while Concur Travel, Deem and Egencia scramble to update their technology.

It also means that the benefit of switching to a modern NDC-enabled travel platform like AmTrav has never been higher, and will only increase from here.

Do you need a corporate travel platform with access to American’s lowest fares out of DFW? Schedule a meeting with AmTrav today to start saving.

P.S. But you say “Not my problem, our team feels the LUV on Southwest Airlines” instead of American out of DFW? That’s great – we LUV Southwest too! Southwest made a big deal of putting their fares into corporate booking tools, but those corporate booking tools are still missing the lowest fares on over 15% of bookings, with lower fares available on AmTrav and Southwest.com.

Curious about how AmTrav develops this data? One of our values is radical honesty, so here’s how we do it (warning: travel industry jargon ahead – schedule a meeting if you need this put in plain English):

- On every flight search, we check both our American Airlines NDC direct connection and our non-NDC GDS connection (the latter is what Concur Travel, Deem and Egencia use).

- We offer customers the lowest of those two options for each itinerary and fare type (Economy, First, etc.).

- When a customer books, we again compare the price from our American Airlines NDC direct connection and our non-NDC GDS connection for the exact itinerary and fare type, and we record those two values in addition to itinerary and fare details (so that we can drill down to, for example, fare types in DFW by month!).

We do this programmatically every day on every single AmTrav booking with an American flight – one way, roundtrip, multi-city, mixed cabin, mixed carrier, whatever.

So that 54% August data above means that on 54% of AmTrav bookings including American in or out of Dallas booked in August, American supplied a lower fare via their NDC direct connection than they supplied via the non-NDC GDS connection (that Concur Travel, Deem and Egencia use).

That 12% August number above (12.4% if you’d like to be precise) is the average fare booked via our NDC direct connection compared to the average fare available via the non-NDC GDS on the same itinerary, or rather the percent higher fare that companies using a tool with a non-NDC GDS connection are paying than companies using travel platforms with NDC access.

Doesn’t make sense? Not a problem, it’s a complex topic with lots of numbers and technology. Schedule a meeting with us, we’ll happily walk through this data and what it means for your company.

Elliott McNamee