Travel Waivers: A Business Traveler’s Best Friend

Travel disruptions happen. Whether it’s due to a snowstorm, a hurricane, or even unexpected fog rolling in, weather-related delays can throw even the...

So without further ado, mid-year cost update. You may have seen the news. You know, if you follow BTN as closely as I do, hotel rates moderated starting in April, airfare started moderating in April, May, and then there was the big news, airfare has actually dropped in June.

[Speaker 1]

So without further ado, mid-year cost update. You may have seen the news. You know, if you follow BTN as closely as I do, hotel rates moderated starting in April, airfare started moderating in April, May, and then there was the big news, airfare has actually dropped in June.

You look at these numbers, you think like, what does that really mean? And then we decided to dig in and share that with you. It would look familiar.

You might also recall, we did a webinar on travel cost forecasting last, I think it was December or January, where, you know, we saw historic rate increases last year, 30% increase in airfare, 22% in average nightly rate at hotels in North America, 11% car rental rate, daily rate increase, forecasted rates were 10%, 11% and 8% respectively. Well, we're seven months into the year, have we seen that? The answer is no, actually.

If you look at airfare, and it's useful to look at the whole year, right? If you think back to 2022, which is our gray line here, you can see January, February, that was that Omicron, demand was still depressed, just, you know, lower fares, lower demand. It was March, April, May, particularly April, May, June, that things started accelerating.

We started seeing really high fares. This is Amtrak data, by the way, but it is corporate, Amtrak corporate data. Things started accelerating, really peaked May, June, July.

Kind of moderated towards the end of the year, at least wasn't seeing the big month over month increases. In 2023, the electric blew here. So we did see a big airfare increase in January and February, but that was just lapping really soft comps from the Omicron time period last year.

March also increased about 6%, but then April, May, June, July, airfares have actually been flat year on year. So that pressure on your travel budget should have left, should have let up. So the forecast was 10% up and we're actually seeing about 5%, even including the January, February, those big increases there.

So I thought that was really interesting. This provides that context. You know, is this really something new and big?

Actually, no, it's something we should have seen coming. And if you look at the data this way, it kind of makes sense. Like things have flattened out and the humongous rate increases that we saw aren't happening anymore.

By the way, we do have time for questions at the end. Please go ahead and stick any questions in. Very happy to answer them as always on the Amtrak webinar.

Hotel nightly rates, similar story. We are just not seeing huge increases. So the forecast was 11% up.

January through July was up 4%. This is pretty much across the board. So two-star hotels up 5%, four-star hotels up six, three stars are at about 4%.

The mix shifts a little bit as well, which helps us get to that 4.3%. And again, the monthly rates, January saw a bigger increase, but February through July, more or less flat. And then car rental daily rates, actually the biggest increase at about 6% year over year, a little bit lower than the forecast, plus 8%. This one actually has been a bit more flat and predictable.

It was really that airfare that was an interesting story. So maybe the forecast webinar next year will be a little bit less fascinating. And actually, here's another part of the story.

The increase in trips drove a lot of the travel budget increase last year. It was 50% increases in trips at existing travel programs. This year, that's a far more moderate 13% increase.

So it is something of a rebound, but not the 50% increase that we saw last year. So something big to keep in mind. Saw something else I thought was interesting about airlines and the results they're posting.

Fuel's cheaper right now. So they're still reporting great results, but it could be that fuel is on their side. Another big theme at GBTA is gonna be in DC.

We've talked to you about this before. We'll keep talking about it because it's important. Where we've been, you think back to last December, American Airlines announced that 40% of their fares would only be available via in DC and direct channels.

They followed through. They did what they said they were gonna do. And on April 3rd, they removed the lowest 40% of their fares from non-in DC indirect channels.

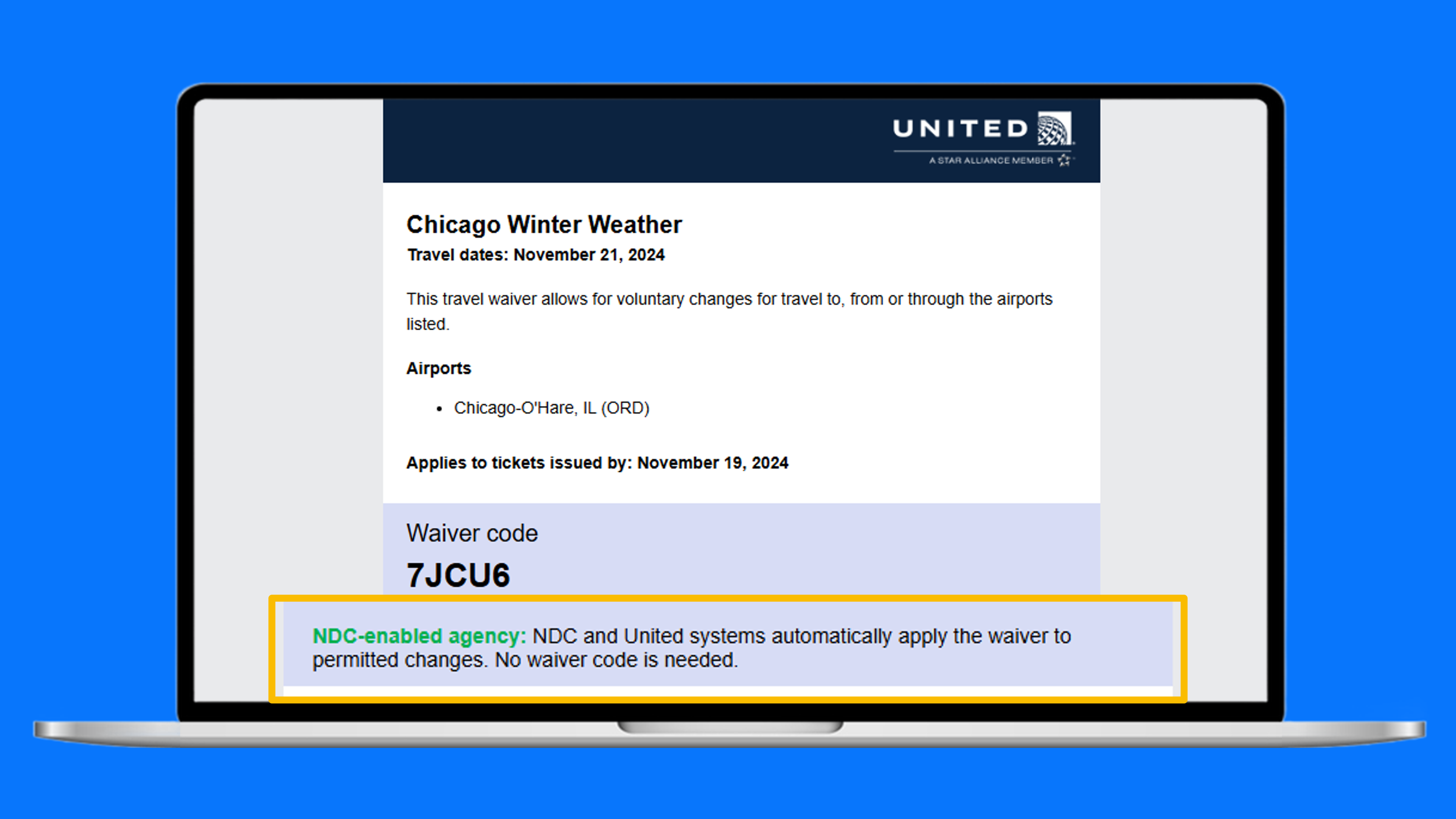

And then earlier this week, United Airlines also announced that basic economy would be removed from their non-in DC direct channels as well. That's coming up in September. I missed their webinar yesterday.

I feel really bad. It was very well attended. Americans did what they said they were gonna do.

If you look, we have been tracking this data since day one. We are looking at actual bookings, tens of thousands of actual bookings to report on this and share this with you. American fares via in DC are lower on 37% of bookings.

So very close to that 40% benchmark that we saw. It's $111 average fare difference when it is different. So that adds up to a 10% savings, give or take via in DC or rather a 10% premium if you're not with in DC, you're not on in DC.

By the way, our data does exclude basic economy fares. We've covered this in the past. Some other things that we saw were obviously basic economy is affected.

And we actually do see some corporates buy basic economy. It's about 3% of our corporate sales. It happens.

What else have we seen? Flexible fares, the rates went up an awful lot, like doubled basically in GDS versus in DC or Edifact versus in DC. And then so flexible fares, premium cabin fares.

So this is not in fact just the 37% of lowest fares, this affects fares across the board. We were also asked and looked into recently, is it just domestic or is it international? Answers both.

It's 38, 39% domestically and 33% internationally. So it is affecting both domestic and international. They said what they were gonna do and then they did it.

Quick tour around the US domestic airlines. I can suppose, Delta hasn't announced anything, although it would be, it's hard to imagine that they're not looking at other airlines in DC moves and thinking that that's something they might need to keep up with. Southwest hasn't done anything new lately.

United, some big changes coming and then American, obviously making the headlines. Shout out Garner Advisory. We follow Garner pretty closely and have a little bit of news about him here, Corey.

But he says, a quick recap of this, the second quarter results are in, American's aggressive strategy to downsize TMC commissions, discounts and its sales team while supersizing in DC had no appreciable impact on their revenue performance. The world didn't end when they pulled some fares out of the GDS. Someone did say like, we'll actually find out what happens in Q4 when there's not as much leisure demand, but that's, we shall see.

That's a good point too. So we'll keep watching. And then Corey pointed out with United Airlines, the big news is not just what they said, but how they said it.

They hinted strongly that this move will not be their last. Makes sense. If you'd like to speak to Corey, we featured him here at Amtrak in the past.

We are very fortunate and really excited to host him at our booth at GBTA. We will have him at 2.15 on Monday and Tuesday, the 14th and 15th. If you don't know Corey, he's a former American Airlines, vice president of sales and distribution strategy.

You could make a very strong argument that NDC would not be where it is today without Corey Garner. He understands this stuff better than anybody else. So if you're trying to fear into the crystal ball and see what this means for your travel program, you would do well to talk to Corey and we'd love to see you and host that.

Last but not least, middle market savings. We are honored, flattered, really excited to share our own research and we're gonna preview that here today. We're gonna share this at GBTA on August 14th at 8.30 in the morning. It's a Monday morning. Fortunately, it's after Sunday. Not Sunday morning, it's Monday morning.

So nobody will have any sort of headache that morning at 8.30. We are gonna talk through, we're kind of talking to the middle market here, right? Big enough to qualify for airline corporate programs. You can get airline discounts.

They'll answer your calls. You're not just on a small business. But also not big enough to qualify for chain-wide programs with the biggest hotel.

So we call this somewhere between 3 million and $15 million of annual travel spend. It is selfishly where Amtrav focuses and specializes. We find that we're a good fit for these travel programs.

We're not here to talk about us. Obviously a big theme is prices are still going up. How do you manage this?

So what we were gonna talk through, and again, this is just the preview, but what we'll talk through on that Monday morning, about 10 days from now is how you can one, develop and pursue a supplier strategy that maximizes your discounts, helps you access and take advantage of money-saving perks and credits. Two, how do we develop travel policies that are clearly displayed and easy to follow? And they, of course, fit your business needs.

Three, how do we ensure great data visibility so that we can analyze, optimize, and report on our savings? Four, this needs to align with technology. This is all supported by technology that supports our travelers and supports our saving strategy.

And then five, you may need a TMC who has your back and is ready to help with this. With this session, the way it's gonna work is there will be an introduction and an overview. That'll be us.

These slides will look familiar. Number two, we will help you benchmark your program against standards. So we have mapped this out, taken feedback on this.

We're excited to share this, this benchmarking exercise. And it's not just the benchmarking, but also a table talk, learning from peers, discussing this with peers, talking through it to think about what are the things that you do really well and where are the places that you might focus a little more. Will I please share the slides?

Sure. Love to. Thank you, Tim.

So we'd love to see you there. We will be in Omni, Dallas-C. Sounds like a very exciting place.

Monday, August 14th at 8.30 a.m. Bright and early. I'll be there. I've already gone for a run.

You know, it's Dallas in August. So that is our quick overview. We would love to see you at GBTA.

As Susan said, our theme is in DC. Where are the fairs? Or where's the fairs?

Don't worry, we did debate how do we grammatically, what's the correct grammatical way to put this? We are right there. I think this arrow is covering up the Four Seasons.

If you're at the Four Seasons, we're nearby. Hyatt's there, Marriott's there, have a hotel corner and Turkish Airlines right there. Susan, do we have ice cream this year?

[Speaker 2]

We have a lot of ice cream this year. We have a lot of ice cream this year. It's to pull you guys in our booth and cool you off a little from a long day of walking the trade show floor.

As you can see, it's really large this year. I mean, if you attended in 2021, which I did, it was really sparse. There was probably one fourth of the number of suppliers.

And this year, it's just amazing how it bounced back. So we're super excited to speak to you and see you live. We will have two demo stations.

So we'll have one on either end of our booth where Elliot's gonna be at one and another gentleman in sales named Eric is going to be at the other. And I'll be there with a cast of Amtrav folks as well from account management and operations and industry relations and other areas and also our global team. So what we'd like to do is we'd like to show you our One Connected platform at that time.

We have our own technology for online booking and as well as everything in between. So unused tickets and pre-trip approvals, reporting, everything's in one platform. So we would love to show you that platform.

And within that platform is something called Gather. It's a proprietary product again for meetings, for online meetings. And it's really taken- Online meeting travel planning.

[Speaker 1]

We're not hybrid meetings, we're not virtual meetings. It's to get the people there, sorry.

[Speaker 2]

So we would love to show you that as well. And Elliot will give you a preview of that. And so please stop by, get some ice cream, chill out a bit and see what we have to offer.

Cool.

[Speaker 1]

So we'll be there. The education session as well. Add it to your calendar.

And that's, and again, 2.30 PM. We will send a follow-up email with these details with a scheduling link if you'd like to schedule time with us. I think the ice cream's there all day.

So don't worry about that. Stop by anytime. Are there any questions that we can answer before we go?

Anything about NDC? This is our shortest webinar yet. I realized we were scheduled for 45 minutes, but we get to give you the gift of 20 minutes back.

Any questions that we can answer in the Q&A?

[Speaker 2]

Yeah, usually there's a lot about NDC because it is not an easy topic, as you probably know. There's a lot of very detailed information that goes around NDC, you know, the fairs. So if you don't have any questions here, maybe formulate some, and you can always come prepared with those questions to our booth.

[Speaker 1]

What are you looking forward to at GBTA, Susan? You're on mute.

[Speaker 2]

What am I looking forward to? I'm looking forward to talking to people I haven't seen in a long time. That's always my favorite thing to do.

I also like to go around and see what the airlines have to offer and some hoteliers, et cetera. We do have one question. How do you recommend handling inconsistency in content product with different airlines?

[Speaker 1]

Yeah, this is the NDC question. And like, this is the NDC question. And it's not just the NDC question, like basic raised this, basic economy in the US raised this, handling spirit and frontier raises this.

They're, you know, from a traveler perspective, it's all about education, not just telling them things up front, but making sure that the tool explains things too. So when they select a basic economy fair, if you don't have a block, which of course you can, but educating them about what that fair is, and, you know, sure you might save, but it's not gonna be changeable. You can't use the unused ticket.

So that's from the traveler perspective, trying to normalize things, but also explain any differences. And that's a balance. You've gotta, like, you gotta control your technology and be able to customize in order to handle that inconsistency in content product with different airlines.

That's one part of it. The other part is of course, pulling it in, normalizing it, pulling it in, being able to shop it, book it, service it, change it. That's what we've run into with American Airlines.

It takes a decent amount of work to do that. That's why the GESs are taking so long, but that is, you know, I mean, what we've, like, the big picture look at in DC is, like, airlines have realized that this works. American didn't, you know, American's financials didn't fall apart when they changed their commercial strategy.

United sees that, Delta no doubt sees that, Southwest knows this. So, you know, they're not being patient anymore, right? It's not a, it's no more wait for the GDS, wait for Concur.

I asked the question, what am I excited, so Tim, I hope that answers your question. I'm happy to talk about it more. What I'm excited for is seeing the next generation of Concur.

It's only 20 years in the making, so I'm excited about that. I'm sure plenty of other people are. Jay, the answer is yes, and we can talk about that separately.

[Speaker 2]

I did want to give, like, a little, maybe a little story about what I'm encountering as we go, and I'm in charge of sales, obviously, but when we talk to new customers, customers that want to have a solution for NDC, when we are in discussion with them and they are in discussion with other suppliers, we hear a lot, well, you know, we want to block those NDC anyway, because we hear we can't cancel them and that travelers en route can't call, you know, back to the TMC.

Well, that is true in many cases, but that is not true with our capability of NDC. We are connected, and we are connected by Direct Connects into airlines. So we have a direct connection with American Airlines that pulls those fares into Amtrav's universe, and we can service those from beginning to end, whether your traveler's en route or whether they have to, you know, make a change or an exchange.

And we don't have to use third-party tools such as Travel Fusion. You may have heard of that tool out there. Many customers do not like using that tool because it's not a US tool.

And in addition to that, it, you know, it costs money to use, and it takes the reservation you've made through a TMC outside of their universe and into the hands of the airline. So that's not the case with us. We can service that airline ticket from end to end.

[Speaker 1]

Unused tickets. Yeah, the one thing that really didn't work was GDS unused tickets over to NDC, and American has taken care of that, and we're able to service it now. And then last question before we give you 15 minutes back, Tim asks, do we have any stats on how much longer it takes a travel seller to handle an NDC booking versus an EDIFAC booking from start to finish?

Good question. On the sales side, it takes nothing extra. On the servicing side, so a trip needs to change, unused tickets are easy, but a trip needs to change.

Many of those scenarios work okay. Some of them don't. In NDC, we handle it.

We've got our ways, whether it's using a tool like Aselia Fairlogix's Spark. We have it integrated into our own GUI, but we can use Spark as well. Worst case call to airline.

Our approach to NDC is NDC is our problem, and we don't wanna make it a customer's problem. And that's easy for me to say in marketing, it's harder for the operations team, but that's the promise we make to customers. So most of them have seen no difference.

And in terms of overall, again, 80, 90% of the tickets that are never touched, those are just fine. And the touch is easy, those are fine. Some of the edge cases do need work, but that's our job, that's what we do.

So thank you all for joining us. We are looking forward to seeing you at GBTA. Look for an email from us.

There will be, we'll repeat the information about what we're doing on Monday and Tuesday, where to find us, how to meet us. If you're not gonna be at GBTA and you'd like to grab a time with us as well, look for an email from us on that. And we are looking forward to seeing you.

[Speaker 2]

And expect a big splash from us because- That's right.

[Speaker 1]

And we've got more news that we didn't preview here. So, all right.

[Speaker 2]

Thank you all. Take care. Bye.

Bye.

Travel disruptions happen. Whether it’s due to a snowstorm, a hurricane, or even unexpected fog rolling in, weather-related delays can throw even the...

A November (or even October) snowstorm is such a rude way for winter to make its return, yet here we are with a Chicago snowstorm this...

Hi, thanks to everyone who joined AmTrav's Business Travel Platform of the Future webinar. The recording and results are here for you. {%...