AmTrav's first webinar of 2024 was a banger featuring our CEO Jeff Klee (follow Jeff on LinkedIn) and distribution expert Cory Garner (follow Cory and Garner Advisory on LinkedIn). Jeff and Cory shared radically honest insight on the current and future of airline sales and corporate travel management that you'll only get from AmTrav (follow us on LinkedIn too!).

Transcript:

Elliott 0:00

Hi folks. My name is Elliott McNamee. I am with AmTrav Corporate Travel. You are here on our first webinar of 2024, which is NDC in 2024. Thank you for joining. We are recording, just as an FYI. We have a lot to cover, so we are going to get moving.

First, who else is here? I am playing Susan today. Unfortunately, she is under the weather, but we are very proud to be joined by Cory Garner, who spent - was it 20 years, Cory, is that accurate?

Cory 0:36

Feels like at least that much if not 40.

[laughter]

Elliott: 0:40

Ha. So Cory was at American Airlines leading Distribution, Travel Agency and Corporate Program Strategies. We think there is nobody better to hear from about Airline Sales & Distribution strategies from outside those airlines. So, welcome Cory.

We are also joined by our CEO and Co-founder Jeff Klee from Los Angeles. Jeff founded AmTrav 30 years ago, and has led our NDC strategy in 2023. There is - we think - nobody better-qualified to talk about what NDC looks like from a Corporate Travel perspective than Jeff. So welcome Jeff. And I’m Susan. I’m actually Elliott McNamee, but like I said, Susan is unfortunately out today.

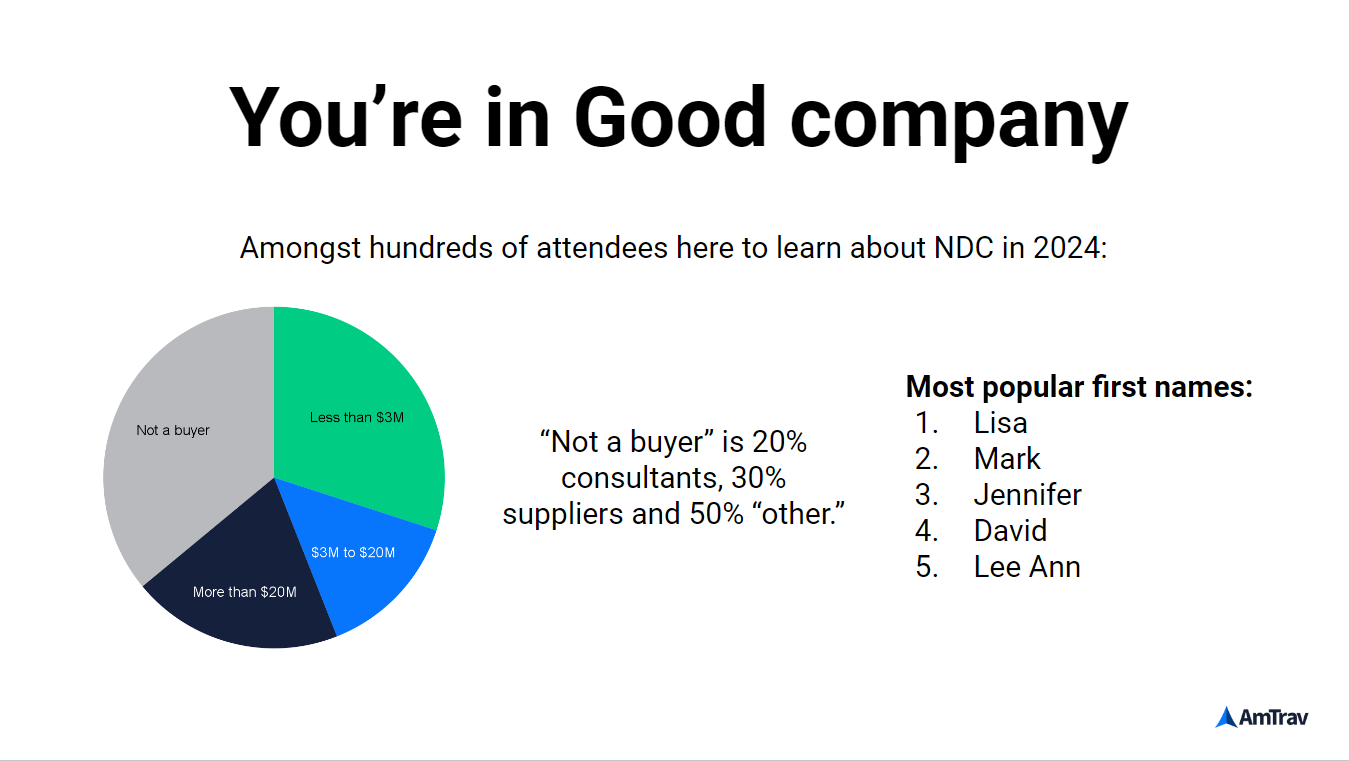

Real quick. You are in good company. We’ve got a nice mix of buyers here; several hundred folks registered. If you look at the demographics we’ve got small programs, we’ve got mid-sized programs, we’ve got large programs here today. Welcome one, welcome all. A bunch of “not a buyer”’s too. That makes 20% “consultants,” 30% “suppliers” and and 15% “other” which is very mysterious and I haven’t gone in to check exactly. The most popular first names if you Lisa, Mark or Jennifer you are in particularly good company. And Lee Ann! What a popular name! Jeff’s married to a Lee Ann too! Everybody’s…

Jeff 2:10

She's definitely not on this webinar though.

Elliott 2:11

You don’t think so? There is a Klee.

[laughter]

There’s another Klee. Welcome, Allan. Finally, we’re gonna reference a couple things. Some recommended reading. One is a guide AmTrav put together, “Modernizing the Flight Booking Experience: Our Vision for a Better Future for Travelers and Companies.” Two is “Where are the fAAres?” This is our report on our American Airlines data in 2023 showing how much customers saved with access to American’s lowest fares. And then third, hot off the presses yesterday with The Company Dime, a subscription that is highly recommended, is Jeff Klee writing about pricing and what pricing’s got to do with it. So. These will come up. We will send out links to these afterwards. So. I’m almost done talking.

What to Expect Today.

First up, we’re here for a discussion with Cory and Jeff. We think they’re really good to hear from. We’re going to answer as many questions as we can and cover as much ground as we can. First up. 2023 was a big, big year for airlines, NDC and fare changes. What happened in 2023?

Up next - 2024. What can you and your travel program expect next year?

And then, how can travel leaders like yourselves prepare? Again, with time for your questions.

One of our values is that we are radically honest, so we will tell it like it is. We will hear it how it is. Really. We will share what we know. We will try not to speculate about what we don’t know. So. With that said - Jeff and Cory, I think starting with Jeff, what happened in 2023?

Jeff 4:00

A lot, and I think we at AmTrav, we obviously embrace NDC. We're big fans of it and what it could mean. We're - and by the way, I like to talk not in terms of NDC, but in terms of modern connectivity. So who cares what the actual protocol is under the hood? We're focused on the capabilities. Right now 47% of our volume is going through modern connections. So, we're proud of that. We think that's a good thing for our travelers.

Now if I have to break it down from there, we've got four direct connections built so far. We've got Southwest which is, I think, the poster child for what this can be. Our Southwest connectivity I think is nearly perfect in terms of the experience we're able to deliver. We're running 100% of our volume through it. We support any kind of servicing you want. We've got complete interoperability, meaning if you make a change on Southwest it will reflect in our booking tool and it'll show on your reporting and you can then service it from there. So, a lot of really cool things on Southwest.

And we've got American where we're also running 100% of our volume through. I would put American in the category of “not perfect yet” but still an obvious leap above what we had before when we were using legacy technology. Our American customers, among other things, can buy extra legroom and seats. If there's a weather waiver, they can change a ticket with ease and not have to worry about a manual process. They've got access to fares and bundles that they didn't have before like Main Plus and Main Select. And just changing tickets is generally easier.

We're also connected to Spirit. Again, I won't go into that too much because there aren't a lot of big Spirit customers here I imagine, but what we have with Spirit is way better than the GDS.

And then last but not least we're directly connected to United Airlines now. We're not using it for all of our customers as we finish ironing out some exchange use cases. However, I will say that I think the United NDC product has the potential to be the best of all of them. I think that they've done some really cool things. It's extremely promising. I think ultimately, travelers are gonna get a great experience booking United through Amtrav because of NDC. There's just still a little bit more work to do.

Of course, in all these cases with all four, customers are getting lower fares than they would get through legacy channels. One point to make to kind of sum all this up. If you think about how in life there's like a “happiness curve" and you could do nothing and you kind of go like this [gestures on the screen]. Maybe there's a slight downward slope. But if you really want to make things better, you've got to accept things that are uncomfortable. You've got to absorb a little bit of pain. So the NDC is kind of like, you know, this curve [gestures on screen] where you go down a little to go way up. And we're never going to get way up if we don't deal with what we have to do right now.

And I think whenever we debate NDC, I always want to make sure we're framing it properly and looking at it in the right context. What we have now, what travelers have now - their ability to really easily and reliably change tickets, a company's ability to know they're getting all the options and the lowest fares, and just having things work really well and really smoothly. It's not good enough. It has never been good enough. And the legacy technology is stuck. It's in a place where “it is what it is.” It's not getting any better. And as airlines differentiate their products and do more things and do different things, we're never going to be able to deliver the kind of experience that travelers want and demand with the old technologies. So to me it’s not a question of, you know, should we move forward with modern connections? It’s how do we move forward and how do we do that as best as possible?

The good news is when I talk about that “happiness curve” is that the “uncomfort” that “pain?” We're absorbing most of it. The vast majority of it is on our side. That's not you as a customer. You, for the most part, don't have to worry about this with very few exceptions. You know, our goal and our job is to deliver these changes seamlessly to you.

Elliott 9:07

So, when you say “our” so AmTrav is a corporate travel agency and online booking tool travel platform. So we do that in development. Cory! What happened in 2023? What would you add?

Cory 9:23

Well, I mean, listening to what Jeff says, everything went great and he's in a better spot. The whole industry ought to be in a better spot than they used to be. But, you know, unfortunately for most of the industry, what AmTrav has done is a bit of a unicorn. Because I think when history looks back on 2023, and what happened particularly in corporate travel, history will say it was a bit of a mess. And I think to understand why it was a bit of a mess, you have to rewind the clock a little bit to some of the beginnings of airline NDC strategies and pushes they’ve made across the years.

Because before it really hit corporate, it hit online travel agencies a very long time ago. And so when online travel agencies were properly motivated, they were able to digest NDC very quickly, and you didn't hear kind of multi-year stretches of screaming and gnashing of teeth over servicing and all this other stuff. And the reason why is to take a closer look at the typical online travel agency. They were born as technologists, they are technologists. They control the entirety of their whole tech stack. Their booking path is their booking tool. They have their own Call Center application. They do their own content aggregation, order management and all the types of things you need to do to be successful with NDC. When you compare that to how the corporate travel chain works, corporate travel has a group of “haves” and a group of “have nots” when it comes to the ability to adapt quickly to technology. And so just like we learned with online travel agencies, the TMCs that have been able to adapt successfully to the NDC environment are those who own most of their own tech stack. So you just heard Jeff explain in a really detailed way how Amtrav has used their own technology to deliver - not just the same as what they were delivering before in an old EDIFACT world - but delivering incremental improvements on both the quality of the content and also the servicing capability. The servicing capability is better when you listen to folks like Jeff Klee.

But there's a whole group of “have nots” in corporate travel, and the “have nots” in corporate travel when it comes to their ability to adopt NDC quickly. If you look at their tech stack, it's this myriad of systems all provided by third parties of various kinds, and they're completely dependent upon these third parties of various kinds to be completely done with all their NDC work all at the same time. And so you can imagine, if you're a company that depends upon 2? 3? 4? or five different major third party technology providers, all of which are at a different stage of adoption of NDC, it’s gonna be a mess. And so I think that's kind of the key reason why we're not seeing a lot of volume flowing through the typical TMC tech stack provided by third parties as of this moment, because it's a huge coordination nightmare, and it just does not go quickly. And so, for most of the industry you're hearing about, you know, “we're doing great work. We got some pilots going.” I got bad news for you. If you’re doing pilots at this point, you're well behind on your homework from 2019. And you're not going to be as well positioned for what's coming next in 2024 as compared to an agency like an AmTrav that controls its whole tech stack.

Elliott 13:10

I want to build on that a little bit more and you know, just kind of [unintelligible]. Maybe we're going to repeat a little bit. But Jeff, Denny asks, “What's the state of NDC? Is it ready?”

Jeff 13:23

I mean, it's an airline by airline thing. And, you know, every airline is moving at its own pace. And the way we looked at it, I mean, I said we've got four connections now. There's probably another four at least that we could do this year from carriers who are ready. There's some that are not yet ready, but they're approaching being ready. And for us, we look at it as “is it better than the alternative?” So “ready” doesn't mean perfect. Nothing's perfect yet. Probably it never will be perfect. But like I was saying earlier, the alternative isn't isn't good enough, in my opinion. I mean, if a traveler can get a better experience on a supplier-direct site, or they can change their ticket more easily than they can in our booking tool, then what we have isn't good enough. And so we're constantly fighting to get to that point where, you know, we want to take all of the content, all of the fares and all the functionality that is in every single supplier-direct site and aggregate it into into one platform that gives you everything, but also gives your company the visibility and the control and the service and the savings. So no, we haven't done that yet. You know, we're further along this year than we were last year. But, we as an industry - it's not easy. It's a tough battle to get where we want to go. So we're getting more ready is the short answer.

Cory 15:09

And Jeff, just a crossfire question here for you. Did I hear you say earlier that you're at 100% NDC with American and also 100% Direct Connect with Southwest as well? Did I hear that right?

Jeff 15:20

Yeah. Yeah.

Cory 15:22

Are there any other airlines that you're 100% with?

Jeff 15:25

Ah, Spirit.

Cory 15:27

And Spirit? Okay. So, here's my answer to that question. If any one TMC can be at 100% with respect to any one airline’s NDC connection, every TMC could be at 100%. And so the question becomes if your TMC is not 100% with that airline, why not? And the answer to why not isn't on the airline side. The answer to why not is in the intermediate steps in between the airline’s connection and the TMC systems. So there's something broken on the TMC side if they are not at 100% as compared to Amtrav, which is because they control all of their own stack.

Jeff 16:12

And I think a lot of our competitors are kind of waiting for “I can plug into this and I'll suddenly have everything” but it's just not working that way. The GDS’s is - and I'm really sympathetic for what they're trying to do - but they're trying to build up all these connections at once to all these airlines and they're really trying to shoehorn in [unintelligible], Their customers - the TMCs are saying “give me NDC in a way that I don't have to change anything. I don't have to do any heavy lifting. I don't have to do any hard work.” And that's not the way the world works.

I mean, I've heard from a CEO of a global TMC that companies like Amtrav, we do one airline and then we call it a win or we declare victory. And we’ve actually done four airlines. But you do have to go airline by airline! And I would think a global TMC could do this at a bigger scale than us and could be way higher than four instead of zero. But the airlines are not commodities anymore. They all have different nuances. And if you do want to work with Southwest, you've got to be able to handle Early Bird, and American you want to make sure that your Advantage members get the seats that they're entitled to, and you could go on and on. United doesn't let you get a residual credit for an exchange. You have to be able to factor in well, if I'm surrendering $100 in an exchange transaction, do I want to do that or want to keep my credit for a later trip? I mean, I could go on and on. But each airline has their nuances and it's our job to deliver the best experience for every airline. There's just no way to get like some kind of completely normalized connection to all airlines where we can deliver everything at the same level of traveler experience that they would get if they go direct. So yes, it is an airline by airline effort for us, but that's our job. That's what we're here for.

Elliott 18:32

And kind of an inside baseball question from Francoise. “What's the average speed end-to-end booking on NDC versus GDS, Jeff? What's the processing time with NDC versus GDS? Is it substantially different?

Jeff 18:48

You mean for a customer as they're going through the booking tool?

Elliott 18:51

Customer, AmTrav, either way.

Jeff 18:53

Yeah. I mean, it's not noticeably different. I mean, I think that we and some other TMCs and those who are trying to connect to some of these more modern connections - we do complain to the airlines and the vendors that there are things - that their response times aren't as good as what we would like. You know, ideally we want to hear back from an airline [unintelligible] when doing a shop in less than a second because that's how Google Flights does it. But some of the NDC connections are slower now. But again, we work through these things and it is a battle, it's a process. We're not 100% there yet. But from a customer booking a flight they're not going to notice this. I mean, I notice, you know, milliseconds, when I see it in the logs. The customers aren’t going to notice that.

Elliott 19:49

And then processing an unused ticket exchange or a change like it works? Is it significantly harder for AmTrav, or 80% of the time is it okay?

Jeff 20:03

So, on the TMC side or for the customer?

Elliott 20:07

From the TMC side. Francois is asking. Francois is trying to find out if you're wearing your Superman cape to get this done? Or like if it's actually doable?

Jeff 20:16

Yeah. So that's a good question. You hear a lot of, “Oh servicing doesn't work in NDC.” I will say it depends. It's an airline by airline thing. I mean, Southwest is 100% reliable. United at the other extreme of the ones that we were working with is less than 50% reliable right now. So that means often there's a lot of manual work behind the scenes. But every airline is getting better and better. And remember, in the legacy world? I mean, you guys - talk about making sausage! Like what goes into changing a ticket through a GDS? I mean, the great thing about NDC and this seems so obvious but in our industry, it's not. With NDC the airline tells you how much something should cost. Like you want to make a change on an American flight, American will tell you this costs $60. In the old world, in the legacy world, you don't have that. Someone's got to figure out you've got like all these tariffs, the fares that are filled with all the pages and pages of rules describing what happens when you change it. Literally, it's the travel agent or the TMC’s responsibility to figure out “how much do we quote here?” And the GDS has built some technology to help but that's far from perfect. That's why you see - like how many GDS-reliant booking tools have really great self-servicing capabilities? I mean, the answer is zero because it is so complicated to figure out what it would cost to change “A” to “B.” NDC is fixing that. Again, it's not perfect, it's buggy. But at least it holds the promise that it's going to get it right. And it will.

Elliott 22:18

So. Two other things to touch on quickly for 2023. One is a question. AmTrav is fairly unique in connecting to NDC services directly. Claire and Raul ask, “does what you say about readiness - is that true of both direct NDC and NDC through GDSs?” So for folks who use a tool - a TMC that's reliant on the GDS. What’s the readiness?

Jeff 22:52

I think right now, you know, we've got great relationships with our GDS partners. Like I said before, they've got a really tough battle. They've got a lot of airlines to integrate and a lot of customers who want them to keep the legacy workflows.They don't want them to change anything. They want everything exactly as is. So I think I mean, the reality is, we can go much quicker. We don't have to do 400 Airlines at a time. We're picking off the airlines and the geographies that are most important to our customers. At this point in the journey, for us it's really important that we have a direct relationship with the providers of the technology, the airlines so we can give them feedback directly when we don't have a large entity in the middle that's going to be a bottleneck for that. So I think at the moment, there's a big difference in the quality. And I worry that the GDSs - again, in trying to normalize everything and try to make everything look the same, so it can be easily consumed - that they’re kind of sucking the richness out of NDC. I mean, the whole point of NDC is to be able to give you new capabilities and rich content that are specific to each airline. And I don't want the normalization done far upstream. Like you know, yes, we're all taking feeds from lots of different airlines and we have to figure out a way to present it to our customers, but I want to be able to control what we show to our customers. I want everything and then depending on who the customer is and what their needs are we can decide what to display. If a GDS is the filter and they're deciding what fits and what doesn't fit in their structures, then the content I'm getting from the GDS is less than I would be getting from the airline. And I don't want that. I hope the GDSs will at some point take a different approach. But right now they're focused on kind of getting just the very basic stuff out the door. And that's not good enough.

Elliott 25:17

You're on mute Cory.

Cory 25:22

Who muted me?

Elliott 25:24

I think you did it yourself. I wasn’t…or was it Jeff?

Cory 25:28

Okay, anyway. To me this is like the old game we used to play as kids - The telephone game? You know. One person tells a story to the next person, to the next person, and the next person. Then it gets all the way around the table, and by the time it comes around the table it's a totally different story than when it started off. But travel distribution is very much the same. You know, you got a message that's coming out of the airline and then it's being passed. If you don't own your whole tech stack as a TMC, it's actually being passed through a series of third parties before it gets to the end customer. And so by the time it gets to the end customer the quality of the content, the quality of the functionality can be very different from what the original API is actually able to support. So I totally agree with what Jeff said. I mean, if you don't have direct visibility into what the airline has and what it can do, how are you ever going to know as a TMC what content and functionality is only being exposed to you? You just don't have the control. And in a lot of cases in this industry unfortunately, it's just simply not working. Not because the original NDC API doesn't work, but because all of the integrations that sit between the end customer and the airline are not complete.

Elliott 26:43

So before we move on to 2024, real quick. AmTrav’s data we published - it was in Business Travel News, a couple other places. We found overall (report here), it was about a 9% savings with access to NDC fares in 2023. American did get more aggressive [unintelligible] or excuse me. American removed more fares from EDIFACT GDS in August. What that meant was that the savings in November, December and into January - the savings with NDC are up to 13%. So there is a big difference in more than half the time that you compare between AA.com and NDC versus a non-NDC connection, more than half of the time the fares will be lower. We promised that we'd share some United data too. We’ve got some preliminary data there. We are seeing that about 37% of the time, a fare is lower from United’s NDC connection compared to the non-GDS. That works out to about 4% savings. Now, it works out to a smaller savings than American because United’s taking a different approach. And actually, why don't we talk about that real quick? Touch quickly on continuous pricing and United's approach versus American. Cory, can you share that real quick?

Cory 28:10

From my perspective, I mean the bones of the two airlines' strategies are very similar. They use a similar technological approach when it comes to NDC. They have similar content, similar capabilities. And what's different is the amplitude and the size and the style of implementation. American came out with some very strong messaging and implemented quite a lot of changes all at once, not just the distribution strategy, and did so in such a way that you know, they caught a bit of flack for just from a bedside manner perspective. United on the other hand, very similar strategy, less amplitude, and a very transparent and welcoming approach and for the most part has not taken quite the number of bullets that American has. But you know, from my perspective these two airlines are pretty close cousins when it comes to the core strategy.

Elliott 29:15

Cool. All right. 2023 is over, folks. It’s time for 2024. Cory, you've just touched on American. You just touched on United. Megan asks, “What can we expect from Southwest and Delta in 2024 and beyond?”

Cory 29:35

Southwest and Delta specifically for 24?

Elliott 29:38

Yeah. And beyond. Take that however you want.

Cory 29:43

I think Southwest has been very clear about their strategy. They continue to hit that that one note being “we want to be everywhere you want to be and so we're going to be the airline that is present in all the channels that you want to be present and I'm gonna make it as easy as possible to transact with me,” which is, you know, smart strategy given the context they're in, you know, they've got some some competitors that are making some big changes on distribution. Southwest is, you know, making themselves available in lots of different channels and being very kind and flexible about that. And I'm sure that's resulting in a bit of share going their direction.

Delta has - let's call it - they've been patiently waiting on the sidelines of NDC for quite some time, watching the rest of the industry play out. And likewise, has probably seen a fairly significant amount of corporate share come their direction, as their competitors, particularly American have taken bolder steps in the area of distribution strategy. Now, might Delta change some of that this year? It remains to be seen. It's a really big step for an airline to go from not not really having a tangible NDC strategy to all of a sudden having one. That's not something you snap your fingers and you just all of a sudden go out and do. So I personally don't expect a tremendous amount of progress in the direction of NDC out of Delta in 2024. I actually think the more interesting thing to watch is that we’re starting to hear Wall Street grumble a little bit about the cost structure at Delta and I can tell you having been at an airline before, when margins are underperforming Wall Street expectations, there's a high degree of pressure to go cut costs. But let me tell you something about airline cost structures. Still gotta maintain the aircraft. You still got to pay the pilots to fly the plane. The flight attendants are still going to be on the plane. You still have to build the plane. The fuel. Okay, what's the next item on the cost structure list that's actually discretionary? Distribution costs. And so there you are in the Delta sales team, you're getting pressure from Wall Street to cut costs, and then the CFO starts looking and says, “hey. We're paying a lot in commissions and I think we're probably going to get that share anyway, given what the other guys are doing. So might we be able to save, you know, just a bit in the commission budget?” So I would probably have my eye closest on the moves that Delta makes in the commission space either back end, up front, that type of stuff, and who knows, maybe we'll even see a bit more conservatism when it comes to corporate discounting.

Elliott 32:49

Jeff, anything you'd add that you expect to see from additional US carriers in 2024?

Jeff 32:57

Yeah, I think most are working on NDC, and they're all at various stages of it. I know I talked to all of them to find out where they are. I think in the case of Delta, I don't know when they will have what, but I think they're taking a very thoughtful approach to distribution. I think that when they do have some sort of more modern connection option, my guess is it'll be pretty good. I they're trying to come late to the battle and to win the war strategy. I think they're going to learn a lot from those who have gone before them. So I'm looking forward to it. I want everyone to have a great modern connection that we could connect to so we can deliver the exact same experiences that they deliver on their own sites.

Elliott 34:08

So that takes us to our next topic. Cory. I'm gonna give it to you as a two-in-one and it will make sense as you start talking about it. One part is What's American's ultimate strategy? And the other part is airlines are getting aggressive with direct-only programs in addition to NDC. Why? And will that continue? So Cory, you say we’re in the third - is it the third stage - of the airline distribution horizon? What is that?

Cory 34:39

I'm calling them eras. I'm on my own Eras tour this year.

Elliott 34:44

He’s selling cookies and he’s a Swifty.

Cory 34:50

I have so few fans though. Yeah, I think what's happening is American is probably leading the industry into what I think of as the third era of airline distribution strategy. The really short version is the first era was kind of mid 2000s through 2012ish, and that was airlines pursuing direct-connects and there was no such thing as GDS NDC deals at that point. It was mainly a cost-saving strategy for airlines to work directly with agencies and edge the GDSs out. The second era was when airlines discovered that NDC could actually drive revenue benefits as well in the form of bundles, ancillaries, continuous pricing. And revenue benefits are something that you want across all channels. And so what started as a cost saving strategy also became a GDS-inclusive strategy for the purpose of driving revenue benefits. But now here we are post pandemic. The second era is starting to draw to a close. The third era is beginning and the third era is going to be about airlines trying to optimize the value of their loyalty programs.

So, American’s CCO Vasu Raja said on their second quarter earnings call, that for every dollar in flight revenue that American makes from a frequent flier member, they make an additional 10 cents from from their loyalty program. And most of that comes from cobrand credit card spend. 10 cents. That doesn't sound like a lot but in the airline business that's a tremendous amount of money. That's 10 margin points. So in an industry where in most normal years an airline is running, you know, five - 10% margin? If you have a way to take a customer that wasn't giving you that extra 10 cents before and turn them into a customer eventually that does generate that 10 cents? That's revolutionary. And so why wouldn't you do everything possible to try to turn those customers into the kind of customers that generate the additional 10 cents? Now, many airlines (and it appears that American may be one of these) believe that the best way to entice a customer into a deeper and deeper loyalty relationship starting from being a member of the program, to flying on your airline more, to ultimately holding that cobrand card and really juicing that ten cent number - many airlines think the best way to do that is through a direct channel interaction. And I don't mean NDC.I mean, the actual website, the actual app. Those systems are built in part to not just handle transactions, but also to manage the lifecycle of a customer relationship and bring the customer into a deeper and deeper relationship with the airline. And so the third era of airline distribution strategy will likely be about airlines using their distribution strategy and their ability to differentiate content and frequent flyer benefits in favor of their own websites and their own apps for the purpose of drawing individual travelers into deeper and deeper relationships to deliver that frequent flyer program revenue.

Jeff 38:24

Cory. I'm curious about your thoughts because that's where I think some of these airlines are making a mistake. I don't think that loyalty and indirect sales are mutually exclusive. And to me, if you're trying to inspire loyalty in a customer, telling them that they can only book in this channel, they can only book this way doesn't seem like the best way of doing that. And I think, part of the problem is that TMCs historically have been, frankly completely uninterested in doing anything that the airlines are interested in. So I don't think TMCs have been very good partners in advancing loyalty agendas. But I mean, when I talk to airlines, I’d love to be part of that effort for them to garner loyalty. If you want us to add a frequent flyer enrollment or a credit card application right into our booking path, just give us the capability to do that and we will. I agree with a lot of what American has done in the last year. I think where they're going too far is something like a business travel program, not working in indirect bookings, only working if you booked direct. Sure, there are travelers who want to book direct, I won't deny that but there are also a lot of companies who don't want their shoppers to book direct and it just seems to me that the amount of business that American is losing from just really upsetting companies who manage their travel and having them book away from American versus the whatever they get who go direct - who leave the managed travel program to go direct just for the business points? Does that math really work for them? I'm curious. I have a hard time seeing it.

Cory 40:44

I mean, I'm partially sympathetic to the argument that you're making and partially not because I think it's a nuanced issue, and it's a segmented issue So take American, for example. Look at the way they compete for a customer in Dallas, versus how they compete for a customer in Boston. Like I don't think that there's a single peanut butter way to compete in both markets at the same time. It has to be segmented. So, if I'm American and I am wanting to win the competitive battle for a traveler based in Dallas? How much of that competitive battle am I going to entrust to a TMC? Well, not much. But in Boston? Well, maybe my answer is a little bit different because I don't have the same network proposition in Boston. I'm up against a couple of competitors that probably have a stronger network proposition than me, probably have a stronger frequent flier base than me. I can't necessarily rely upon my frequent flyer program as the only tool to be in that market. I might need a bit of help from TMC, from the corporate travel manager or whatever else. And so the way I view the world is airline competition plays out with lots of tools in the toolbox. Some of those tools are incentives and discounts that are applied at the account level whether that's a TMC account, or whether that's a corporate account. Some of those tools are applied at the individual traveler level, mostly in the form of the frequent flyer program. The optimal airline competitive strategy is a mix of those things. And it's a mix that plays out differently market by market. And so I think, you know, the argument that you make that TMCs ought to be part of the picture and driving loyalty I think it's a great argument to make, and not just your American relationship, but other airline relationships as a third era plays out because I tend to agree that TMCs have a role to play but you may have a bit of a mountain to climb and improving out your value proposition in that regard, because engendering loyalty at the individual passenger level hasn't been something that TMCs have been known for in the past.

Elliott 43:00

Looking forward to the third section of our webinar, what can buyers do? Is there an opportunity for buyers in there, Cory? How does a buyer navigate that?

Cory 43:18

Yeah, I mean. Well, I think there's two things. There's an opportunity and there's a responsibility. So the opportunity is, look, you may not be 100% enthused with everything that American Airlines has done. However, at least they're telling you how the game is played. And if they tell you that part of how the game is played is individual travelers who show more loyalty to me get better deals, and therefore their company get better deals too, then incorporating how to play the loyalty program game as part of your managed travel program strategy that's the opportunity. But there's also a subtle obligation I'm sure we'll get to this in a minute. The obligation is if airlines start using things like “you can only earn miles through my direct channels” or “you can only upgrade for tickets on my direct channels” or something like that, there can be some bookings in your program to go airline direct, whether you like it or not. And so there's an obligation on the part of the corporate travel manager to figure out “how do I turn airline websites and apps into blessed components of my managed travel program that are integrated nicely from a technological and operational perspective with the services that my TMC provides?”

Elliott 44:44

Well, so peering into your crystal ball, Cory, how important is supplier direct in the future? Maybe, you can answer this in two parts: 2024 and beyond.

Cory 44:55

I think it starts in 2024. I think you're gonna start seeing strategies like the one that I just laid out. You're gonna see airlines start to use frequent flyer programs as a tool. And I don't think they're gonna be mean necessarily in trying to do this, but the reality is, is once an airline starts to use a frequent flyer program as a lever, it's actually causing your travelers interest to start to diverge from the company's interests. And so I think in my crystal ball for 2024 I'm going to see more and more of that behavior, not just from one airline, but I suspect that we'll see that from multiple airlines starting this year. And the impact could be sudden, depending upon how strong the strategy is, because at the end of the day, think of how much easier it is for a traveler to switch channels than what we've experienced in the corporate travel market so far with NDC adoption. A traveler switches channels like that. It's done. And the after effects of what happens after they switch channels, that's somebody else's problem. So, you know, I think you could see - depending on how strong the strategies are in the market starting this year - you could see a fairly substantial impact by fourth quarter this year.

Elliott 46:25

Cory, Cory. So we've got eight months.

Cory 46:31

Well I think it's considerably less than eight months, but by the time we get to the fourth quarter, there could be substantial volume. Nothing is 100%. Nothing's binary. Well, it's not gonna be all the volume going that way or all the volume going this way. It happens in degrees. So the best way to think about it is any any corporate account out there that has a segment of their traveling population that are road warriors, and highly exposed to the markets where airlines are employing these strategies. You're the ones that have the risk of a larger percentage of your volume going to airline websites and apps, regardless of whether you're happy about that or not. And so the question becomes, how do you adjust to that? How do you partner with your TMC to do it?

Jeff 47:19

I mean I think that's already an issue. I mean, road warriors often want to book direct anyway. So I mean, as a corporate travel platform, I think it's incumbent on us to attack this in multiple ways, but one is to find a way to support that and that's something that we talk to airlines about and it's yet another thing that NDC brings a lot of promise. Like that we can integrate with direct bookings and more multi-channel interoperability where someone maybe books directly with an airline but we can still pull up the record, we can still report on it, we can still track it for for duty of care, we can service it, we can apply policy, we can do anything with it and we could still be part of a managed travel program.

I think that that's one area where we are already exploring and we'll go deeper with finding ways to support those travelers who do like to book direct. But it's also to the extent that we can close those gaps and reduce the need or the desire to book direct. I mean, part of the reason that in some cases, people want to book direct because their company wants them to use a booking tool that sucks and they hate and the experience is bad. We can control that. We can build better experiences to make people less likely to want to go direct. I mean, the bigger picture, and I think this is something for all TMCs is “how can we -and I think there's gonna be a lot of noise for a few years - but how can we find an equilibrium?”

I think it requires two things. I think, if you think about what airlines want, without a doubt anyone who's selling airline tickets is going to have to connect through modern connections that allow the airlines to sell all of the products they want to sell in the way they want to sell. I think we need commercial models that make sense for airlines. I mean, it's you know, quite frankly, the commercial model airlines pay a ton for distribution. There are lots of misincentives. Airlines are paying the GDS, the GDS are sending kickbacks to us and it's a really inefficient model. Airlines are not going to tolerate it. It's not going to last. We have to accept that and come up with a financial model that works for the airlines that doesn't create this huge incentive for them to go direct and then TMCs have to prove their value. Like I was talking about with, you know, how can we help foster loyalty. But it's also if you're a travel buyer, I would argue, you also have a role to play and you also can speak up and make clear what you want. I mean, I think, I think you know, and I'm obviously biased here, but I think the ideal scenario is we get to a point where the technology and the commercial models under the hood support an ecosystem where third party platforms can offer full content - everything that an airline offers in these managed travel platforms that allow companies to get all those things that they need in terms of visibility and control. And I think that lots of companies move in a direction of a direct-only strategy and they come back. I mean, I just read today. I mean, Ryan Air just struck a deal with kiwi.com. And I don't know how many of you follow consumer travel trends, but in a million years, I would never have guessed that that could happen. I mean, Southwest used to be all direct, Apple was all direct, Dell was all direct. So you would think if you're providing a service, you want to be where your customers want to buy you. But it's incumbent on us, the TMCs to make that palatable for the airlines. I'm optimistic we can get there. I think it's gonna require a lot of big changes to everything - technology, commercial, you know, just philosophy, mindset, but I think we can get to a really good place and I do honestly believe that in the end this is all gonna be way better for travelers and companies. It's just going to be a little bit messy while we try to get there.

Cory 52:04

Yeah, and I think if the corporate travel industry has proven anything, it's proven that it's going to take a good while to get there. Especially from a technology and a process perspective. You know, if you really think about the implications of what we're just talking about - airlines pushing true direct channel. Well, that means that some corporate Travel Bookings are going to be originating on airline websites and apps and that's going to need to be integrated somehow with what the TMCs were already doing. You need to have cross-channel servicing capability, and all at the same time that many TMCs are still working on their homework for 2019. As a TMC, a TMC that's still working on NDC pilots has no hope to deal with what's going to be happening in 2024 with respect to airline website bookings. A TMC like that is still gonna be working on all the 162 use cases from just normal NDC usage, while the rest of the world is trying to solve, you know, how do I deal with interoperability of airline direct channel bookings also using NDC? And so there's a considerable, and there's already been a considerable amount of change that has not been fully digested by the market. And more change is going to be heaped on top of that. It's the backlog is growing faster than the backlog is being resolved, particularly if you're a TMC that doesn't control your whole tech stack.

Elliott 53:41

Awesome. All right, we are at six minutes till the hour. Thank you, everyone. For your time and questions. Cory, Jeff. Any other closing thoughts before we get a couple more questions in from the audience?

Jeff 53:56

I mean, I could talk about this all day, but let’s get to the questions you want to hear about.

Cory 54:01

I just want to hang out with Jeff some more.

[laughter, unintelligible]

Elliott 54:07

You bring the cookies. I like this question. Somebody asks, “What would you say to all the CTMs?...” Oh, I'm sorry. I was thinking about was CTDs. Well, we'll take this one. Anyways. Cory, “What would you say to all the CTMs (so I assume it's corporate travel managers) waiting for Concur to be ready?”

Cory 54:32

Talk to your friends. I mean, I have so much admiration for corporate travel managers, because think about it. Nobody goes to a particular university for a degree at how to become a corporate travel manager. And so you find yourself in a career as a corporate travel manager in a company, you're in the finance department or the HR department or whatever, and what you do is so fundamentally different than than what everybody else around you do that when you start talking gobbledygook like EDIFACT and NDC, you feel like you're alone. And so it makes complete sense to me why there are thriving organizations like GBTA and the various chapters and all this informal networking that happens. There's a small group of corporate travel managers out there who sit at the intersection of, they totally get it and they can or actually have done something about it. Phone a friend is the best thing I can tell you to do.

Jeff 55:34

The other thing about corporate travel managers is that they're going to be desperately needed for a very long time. Although their work is not going to get any easier, I'm afraid.

Elliott 55:44

Somebody asks, “my TMC said that they were applying additional transaction fee if I turned on NBC content, and that would apply to all flights for that airline regardless of whether it was NDC. Feels like that would eat up a lot of the savings. [unintelligible] let us know we can give you the numbers and you can do the math yourself in the first place. Jeff or Cory, is that because TMCs wants to discourage the use of NDC?”

Jeff 56:12

I mean, Elliott, you know how I feel about this. We've talked about this privately a lot. I mean, I think it is a TMCs job to deliver content and to deliver the lowest fares and yes, it makes no sense to say like “well, if you want the lowest fare I'm going to have to charge you x to get the lowest.” That's what we're supposed to be doing. You know, we always have a saying within Amtrav you know, “we don't make our problems our customers problems” and it's not a justifiable surcharge in my opinion.

Cory 56:51

So to me it's Game Theory. If you're a TMC, that has an efficient tech stack because it's provided by a collection of third party providers, that drives inefficiency in your operation. If you feel like you can charge more and get away with it and maybe even convince your customer to stay in the legacy environment and not complicate your life, then that's what you do. If you think, however, that by charging more for the service that it could cause the customer to look elsewhere, then maybe you don't do it.

And the last thing I'll say about this question is, if you think getting access to NDC content is your number one problem for 2024. No. That's actually work that should have been done by now. Because what you're gonna be dealing with in 2024 is so much more than that. So whatever you do, you gotta get out of this phase of arguing with your TMC over transaction fees related to NDC as fast as you possibly can. Because if you're having this discussion with your TMC right now, you're woefully unprepared and you will be caught flat footed this year.

Jeff 58:07

And it's frustrating to me that if if every TMC, especially the really big ones, would fully embrace NDC instead of trying to delay it with tactics like this, you know, as I said, NDC is not perfect and you know, I could go airline by airline and you know, give you the list of battles that I'm fighting with them like, “hey, we need this, we need this. We need that.” If there were a lot more voices in those rooms and a lot of, especially some of the you know, really large, strong voices that we have, there's no doubt in my mind that things would get better more quickly, and we would all be better off. Unfortunately we don't have that now because most of the industry is still trying to fight something that's inevitable.

Elliott 58:56

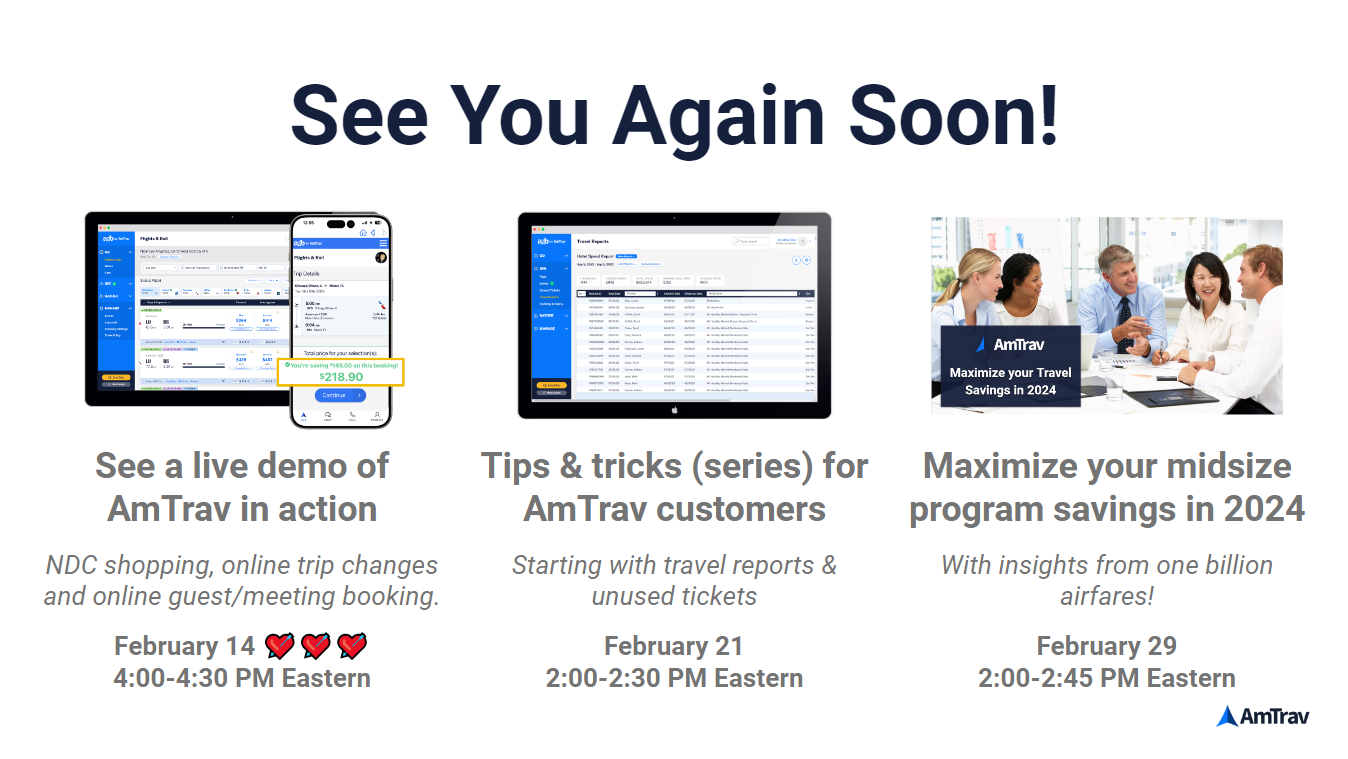

Awesome. Thank you to everybody for your time, for your questions. If you have not seen enough here and you want more, we have more webinars coming up in February. We have an action-packed February. We will be doing a live demo of AmTrav in action so you can see what it looks like to shop for NDC fares and book them to see what it looks like to change them online and see our online [unintelligible] meeting. We'll see you on Valentine's Day if that sounds good. If you are an AmTrav customer we are launching a new series of webinars, tips and tricks for you. First one of those who's in about three weeks, and then our next regularly scheduled webinar is “Maximizing your Mid Size travel program savings in 2024.”

Thank you to Cory. Thank you to Jeff for your time today. If you'd like to get in contact with us, SusanA@AmTrav.com would love to get your questions. Likewise, I'm ElliottM@amtrav.com. Again, thank you, Cory. Thank you, Jeff. Thank you for everybody who joined us.

Thank you. Thanks. Everyone. Take care

Shannon Marvin