Have you ever wondered how your travel management company (TMC) makes money and pays their bills?

On AmTrav’s “TMC Secrets” webinar (watch the webinar here) AmTrav CEO Jeff Klee and Bid Logic Solutions CEO Bryan Holmes revealed where AmTrav’s revenue comes from today and how this could change in the coming years.

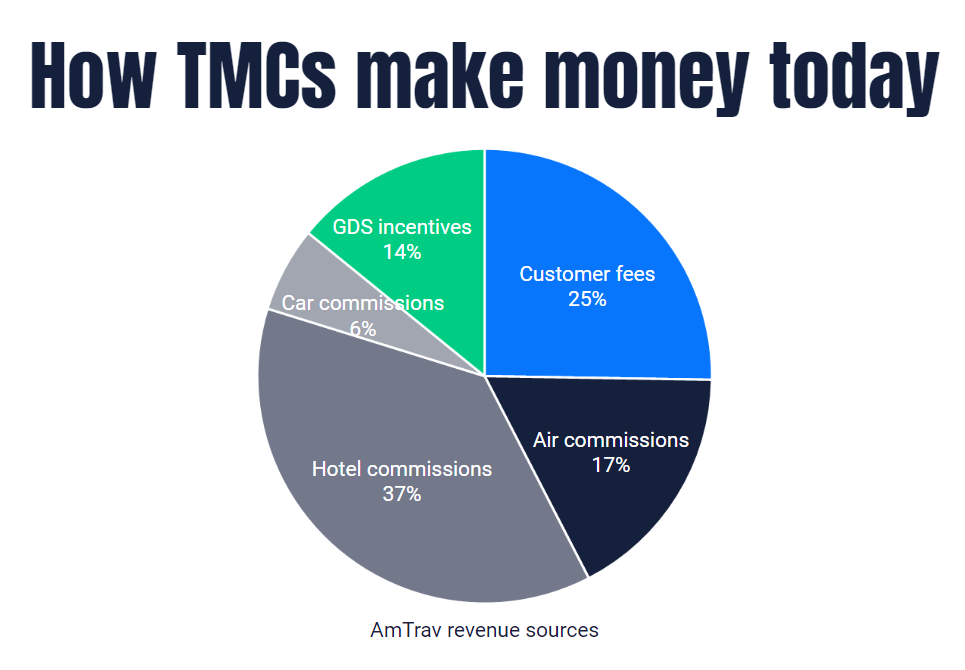

How AmTrav makes money today:

“The most important thing is that 25% comes from customer fees – but all the rest come from supplier commissions,” said Jeff. (Supplier commissions meaning all the commissions and GDS incentives listed in the chart.) “This may not be representative of all TMCs, AmTrav is unique as a digital TMC with really high online adoption so lower fees, but I expect that most TMCs have at least 50% of their revenue coming from supplier commissions.”

Bryan agreed from a customer perspective: “This doesn’t come as a surprise, I think this pie chart has been shifting as transactions have moved from offline to online and supplier commissions have come down.”

Looking closer at those supplier commissions, for most TMCs, hotel commissions are a huge chunk of their revenue — so they do really appreciate when your hotel agreements are commissionable, and those commissions do help pay the bills. (And hotels offer the same discounts whether the rates are commissionable or not.) And further, despite the predicted demise of global distribution systems (GDSs), GDS segment fees paid by GDSs to TMCs are still an important component of TMCs’ revenues.

Ultimately, though, this means that any decrease in supplier commissions has a huge impact on the TMC’s revenue and bottom line.

And how could this change in the coming years?

The main thing, as Bryan pointed out, is that those supplier revenues are under pressure (translation: going down). Marriott reduced hotel commissions several years ago, part of American Airlines’ distribution strategy is reducing airline commissions, and United Airlines is updating airline commission rates too. And NDC bookings that don’t qualify for GDS segment fees reduce that GDS incentive bucket too. TMC staffing shortages and missing NDC fares are also symptomatic of this pressure.

So TMCs are getting squeezed, and will need to figure out how to raise revenue or reduce costs so they can keep making money.

Tune in tomorrow (or watch the webinar!) to learn how savvy travel managers like you can prepare for this challenge (part 2), and on Friday for hot takes from Jeff and Bryan on the webinar (part 3).

Elliott McNamee